Dental insurance in California, Texas, or other states can feel like a maze of paperwork, terms, and limits — but we simplify it. At Gold Coast Dental, serving California & Texas (and helping patients who move between states), we help you pick, use, and get the most from your dental plan. Whether you’re checking coverage for your child’s first visit or wondering if dental implants are included, this guide walks you through it.

What Is Dental Insurance and How Does It Work?

Dental insurance helps manage the cost of care — from preventive exams and cleanings to restorative work like fillings and dental crowns. You (or your employer) pay a monthly premium. At your visit, you may face a deductible, coinsurance, or copay. The plan pays part of eligible costs, up to its annual maximum.

Difference Between Dental and Health Insurance

Health insurance handles many unexpected emergencies. Dental plans focus on prevention and maintenance. Expect fixed yearly limits, defined tiers of coverage, and clear rules about what is allowed.

Is Dental Insurance Worth It in California?

In many cases, yes — especially in higher‑cost regions. If you keep up with two cleanings a year and occasional basic treatment, you often recoup premiums. For more extensive work such as crowns or bridges, a strong plan can save you hundreds to thousands of dollars.

How Does Dental Coverage Work for New Patients?

Most plans start paying for preventive care immediately. Major services may carry a waiting period of several months to a year. At Gold Coast Dental, new patients receive a free consultation, exam, and X‑rays — even without insurance.

Why Dental Insurance Matters for Families

Coverage helps kids get cleanings, fluoride, and sealants on time. Families also use plans for early interceptive orthodontic treatment, which helps guide jaw growth and reduce the need for more complex orthodontic care later.

Premiums, Deductibles & Annual Maximums Explained

- Premium: Your monthly payment to keep the plan active.

- Deductible: What you pay first before benefits begin.

- Annual Maximum: The most the insurer pays per year; after that, you pay all costs out of pocket.

Coverage Tiers: Preventive, Basic & Major Procedures

- Preventive (often 100%): Cleanings, exams, X‑rays.

- Basic (often 70–80%): Fillings, simple extractions.

- Major (often 50%): Crowns, bridges, dentures, medically necessary root canals.

Many insurers also use a “100‑80‑50” model: preventive services at or near 100%, basic at about 80%, and major around 50%. Exact numbers vary by plan.

Dental Insurance Plans

When your employer offers dental insurance — or when you shop on your own — you’ll see tiers like Bronze, Silver, Gold, and Platinum. Bronze plans keep premiums low and focus on preventive care. Silver adds more basic restorative coverage. Gold typically improves coverage for major work like crowns and bridges. Platinum plans have higher premiums and broader benefits; some include parts of orthodontics. Choose based on your dental history, expected care, and budget.

How to Get Dental Insurance

You can get coverage in three ways:

- Through your employer: Many California and Texas employers include dental benefits.

- Individual purchase: Buy directly from insurers or a marketplace.

- State‑supported programs: In California, Covered California offers medical plans with optional pediatric/adult dental add‑ons depending on income. In Texas, residents can shop individual plans from major carriers; select low‑income programs may assist children and qualifying adults.

How Much Is a Dental Cleaning Without Insurance?

A routine adult cleaning without insurance usually ranges $100–$250 depending on location, whether X‑rays are included, and the complexity of the visit. Membership and discount options at Gold Coast Dental can lower preventive costs substantially.

In‑Network vs Out‑of‑Network at Gold Coast Dental

In‑network dentists accept negotiated rates, lowering your costs. Many insurers pay only for care that is medically necessary. Services considered cosmetic or non‑essential are excluded. Out‑of‑network services may be limited to urgent situations, so always confirm provider status.

Common Exclusions, Waiting Periods & Limitations

- Cosmetic dentistry like whitening and elective esthetic work.

- Elective adult orthodontics (unless your plan lists an adult benefit).

- Some advanced gum surgeries, bone grafting, and certain oral surgery procedures.

California update (AB 1048): As of January 2025, California law prohibits waiting periods and pre‑existing condition exclusions for large‑group insured dental plans, giving eligible patients faster access to covered care.

How to Read Your Dental Insurance Policy

- Coinsurance: The percentage you split with the insurer after the deductible.

- EOB (Explanation of Benefits): A summary of how a claim was processed; it is not a bill.

- UCR Fees: What the plan considers the usual charge in your area.

If you have more than one plan, coordination of benefits (COB) rules apply. One plan is primary and pays first; the secondary plan may cover remaining eligible costs. In California exchanges, embedded pediatric dental coverage often acts as primary.

Coverage

Here’s how common services are typically handled. Exact benefits vary by plan and state; always check your policy documents.

- Root Canal: Many PPO plans contribute 50–80% after deductible when clinically necessary. Coverage may vary by tooth type (anterior vs molar) and network status.

- Braces / Dental Orthodontic Coverage: Often limited to children with a separate lifetime maximum. Adult orthodontics may be excluded unless your plan lists it.

- Invisalign: Some PPOs include Invisalign under orthodontic benefits with partial coverage; the percentage and lifetime max differ by plan.

- Medical vs Cosmetic Veneers: Cosmetic veneers are usually not covered. If veneers restore function after trauma or wear, some plans may contribute under major services.

- Dental Bonding: Bonding for cosmetic improvements is often excluded. If bonding restores a chipped tooth or treats decay, plans may cover it as basic restorative care.

Patient responsibility: We provide detailed estimates, but patients are ultimately responsible for any costs not covered by insurance. Copayments are collected at the time of service before treatment begins.

To evaluate your dental insurance, please visit this link: We Accept Your Insurance

Maximizing Your Benefits

- Book cleanings early in the benefit year.

- Second cleaning timing: some policies require six months between cleanings, so a late‑year visit is not always available.

- Request predetermination for major work.

- Submit claims promptly with full documentation.

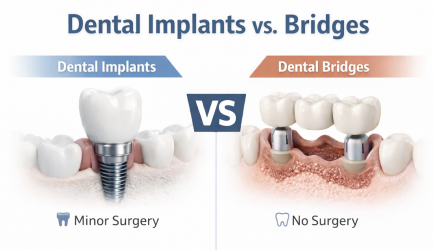

Which Dental Insurance Covers Crowns & Bridges?

PPO plans often deliver the best mix of flexibility and coverage for crowns and bridges (commonly around 50% after deductible). Learn more about our dental crowns care.

Major Treatments: Crowns, Implants & Orthodontics

- Crowns: Frequently covered at about 50% under major services.

- Implants: Coverage varies; many plans exclude implants, but some premium PPOs offer partial benefits.

- Orthodontics: Often pediatric‑only with a lifetime maximum; adult coverage is plan‑specific.

Alternatives to Traditional Insurance

We offer an in‑house discount dental plan for uninsured patients: two preventive cleanings per year, free exams and X‑rays, and reduced fees on select procedures — with no waiting period.

Dental Insurance & Emergency Dentistry

Insurance can lower emergency costs, but urgent care is always available. For same‑day support, see our emergency dentistry page.

Key Dental Insurance Terms

Premiums

Premiums are the recurring payments that keep your dental plan active. They’re usually billed monthly and vary by plan type, coverage level, and how many family members are covered.

Deductible

The deductible is the dollar amount you pay out of pocket for covered services before your plan starts sharing costs. Some preventive care may be covered before the deductible; most other services apply to it.

Annual maximum

The annual maximum is the total amount your plan will pay for covered treatment in a benefit year. After you reach that cap, you pay the full cost until the next plan year.

Assignment of benefits

Assignment of benefits means your insurance pays the dentist directly instead of reimbursing you. You’re still responsible for any part the plan doesn’t cover.

Benefit summary

A benefit summary (or summary of benefits) outlines what’s covered, what you pay (copays or coinsurance), waiting periods, and limits. Review it before treatment so there are no surprises.

Co-payment (co-pay)

A copay is a fixed fee you pay at the visit for certain covered services (for example, $20 per exam). It’s separate from the percentage you may owe as coinsurance.

Coinsurance

Coinsurance is the percentage split between you and the plan after the deductible is met. For example, if a filling is covered at 80%, you pay the remaining 20%.

Fee schedule

A fee schedule is the list of allowed amounts the plan uses for each procedure. In-network dentists agree to these amounts; out-of-network offices may charge more.

Balance billing

Balance billing is when an out-of-network dentist bills you the difference between their fee and the plan’s allowed amount. This usually doesn’t happen in-network because fees are contracted.

Basic dental services

Basic services are common restorative treatments such as fillings, simple extractions, some root canals, and some periodontal therapy. They’re usually covered at a higher rate than major services but lower than preventive care.

Contracted fee

A contracted fee (negotiated rate) is the price an in-network dentist agrees to accept for a covered procedure. You pay your share based on that contracted amount, not the office’s standard fee.

Credentialing

Credentialing is the review process an insurer uses to confirm a dentist’s license, training, and professional standing before adding them to the network. It helps patients find qualified in-network providers.

Exclusions

Exclusions are services a plan does not cover. Common examples include cosmetic whitening, elective adult orthodontics, and certain procedures that are not medically necessary.

In-network adjustment

The in-network adjustment is the discount from a dentist’s standard fee down to the plan’s contracted fee. This adjustment lowers your overall cost when you visit in-network providers.

Estimated Costs With vs Without Insurance

| Treatment | Avg. Cost (no insurance) | Typical Covered % | Your Cost With Insurance |

|---|---|---|---|

| Cleaning | $100–$250 | ~100% preventive | $0 |

| Crown | $800–$2,500 | ~50% major | ~$400–$1,250 |

| Root canal (molar) | $890–$1,500 | ~50–80% basic/major | ~$445–$1,200 |

| Implant + crown | $3,000+ | Varies / often excluded | $2,000+ out of pocket |

Our Insurance Process at Gold Coast Dental

- We verify benefits before your visit.

- We estimate out‑of‑pocket costs up front.

- We file and track claims for you.

Questions to Ask Before Choosing a Plan

- What is the monthly premium?

- Are cleanings and exams fully covered?

- Is there a waiting period for crowns or root canals?

- What is the annual maximum?

- Can I use my preferred office at Gold Coast Dental locations?

Local Support Across Our Offices

We accept dental insurance in all our California offices and our Texas location. You’ll find access across Brea, La Habra, Fullerton, Orange, Riverside, and more.

No Insurance? Affordable Dental Care at Gold Coast Dental

If you don’t have dental insurance, you can still receive quality, affordable care at Gold Coast Dental. We offer flexible payment options designed to fit different budgets and in-house financing with simple monthly plans. Patients can also apply for CareCredit, Sunbit, or Lending Club financing to spread out the cost of treatment. For new patients without insurance, we provide a $49 special that includes exam, X-rays, and consultation, making it easy to get started.

$0 Down Payment – 0% APR – 0 Hidden Fees : Ask yours for details.

Our goal is simple: whether you have a PPO, HMO, or no coverage at all, you’ll always find a cost-effective path to the care you need.

Contact Gold Coast Dental

Gold Coast Dental — 24/7 call center: (562) 242‑1411